Additives

Last updated

Last updated

Business context:

Additives provide detailed specifications for credit products, covering aspects like collateral, durations, amounts, and interest rates, and considering the client's profile when necessary. For example, within a single credit product, three different additives can be created with varying amounts within the product's overall range:

Additive 1: Available to clients with a credit score above 690 points and no collateral required.

Additive 2: Available to clients with a credit score of 690 points or less and no collateral required.

Additive 3: Available to clients regardless of credit score, but requires a guarantee.

For each additive, the system allows the financial institution to define loan terms within the limits of the credit product's terms and interest rate. Each additive includes a script that calculates the available limit for the participant and generates an offer. Additionally, a validation script is configured to assess the estimated securitization, determining the borrower's eligibility for offers that require specific types of securitization.

Important: Each credit product must have at least one additive.

When a product is created, the system labels it as an 'Empty Additive Product.' This label signifies that at least one additive must be created for the product to be included in determining credit limits and the assembly of offers.

Here is an example of an Additive creation form:

Customizing Credit Product and Additive Templates

FIs can modify these templates through coding to fit the specific needs of their credit products. However, the core data model structure—comprising 'credit product' and 'additives'—remains unchanged.

The creation form for an additive requires the following:

A distinct script for each type of process.

An Offer Generator script, as detailed in step https://app.gitbook.com/o/GjSGByguUgFaXlshNiyi/s/UIyo0W6h9h3OnGtkW2pQ/~/changes/3/timveroos-setup-guide-v.-3.7.9/configuration-of-the-offer-generator-script

Schedule engines defining the rules for creating a payment schedule. timveroOS supports custom interest accrual schemes. The provided screenshots include standard options like annuity and principal engines.

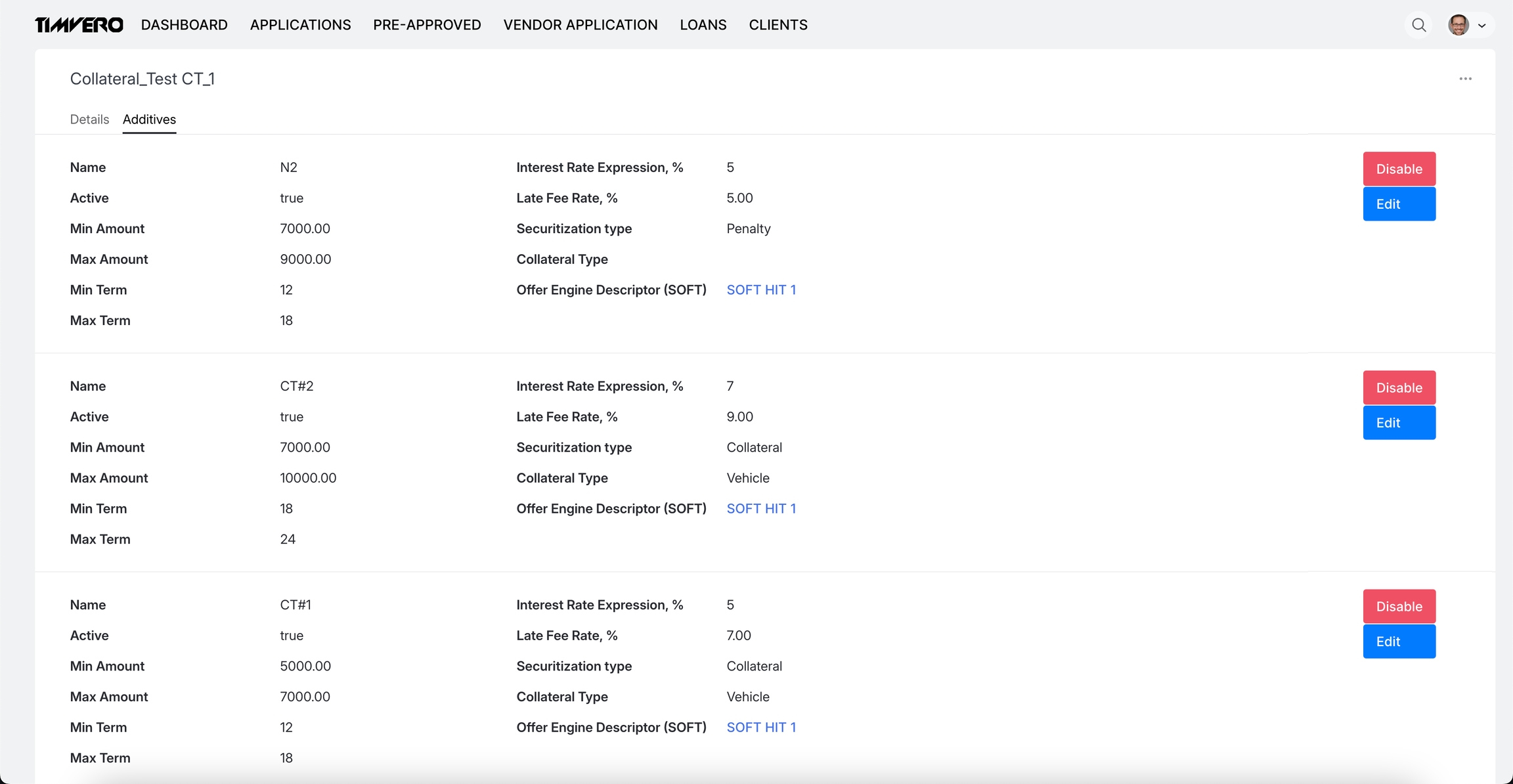

Example of rendered additives:

For the 'SUCCESS' product, two additives have been defined, each varying in maximum loan amounts, interest rates, and securitization requirements. If a borrower does not provide a guarantor who meets the underwriting criteria, timveroOS will still generate an offer for the additive. However, this offer will not be selectable until a suitable guarantor is added to the application and successfully passes the underwriting process.

Users have the flexibility to add an additive to the product at any time, not just during the initial product creation. They can also remove any additive that is no longer applicable.