[Operational Dashboard] - under the UPD

Last updated

Last updated

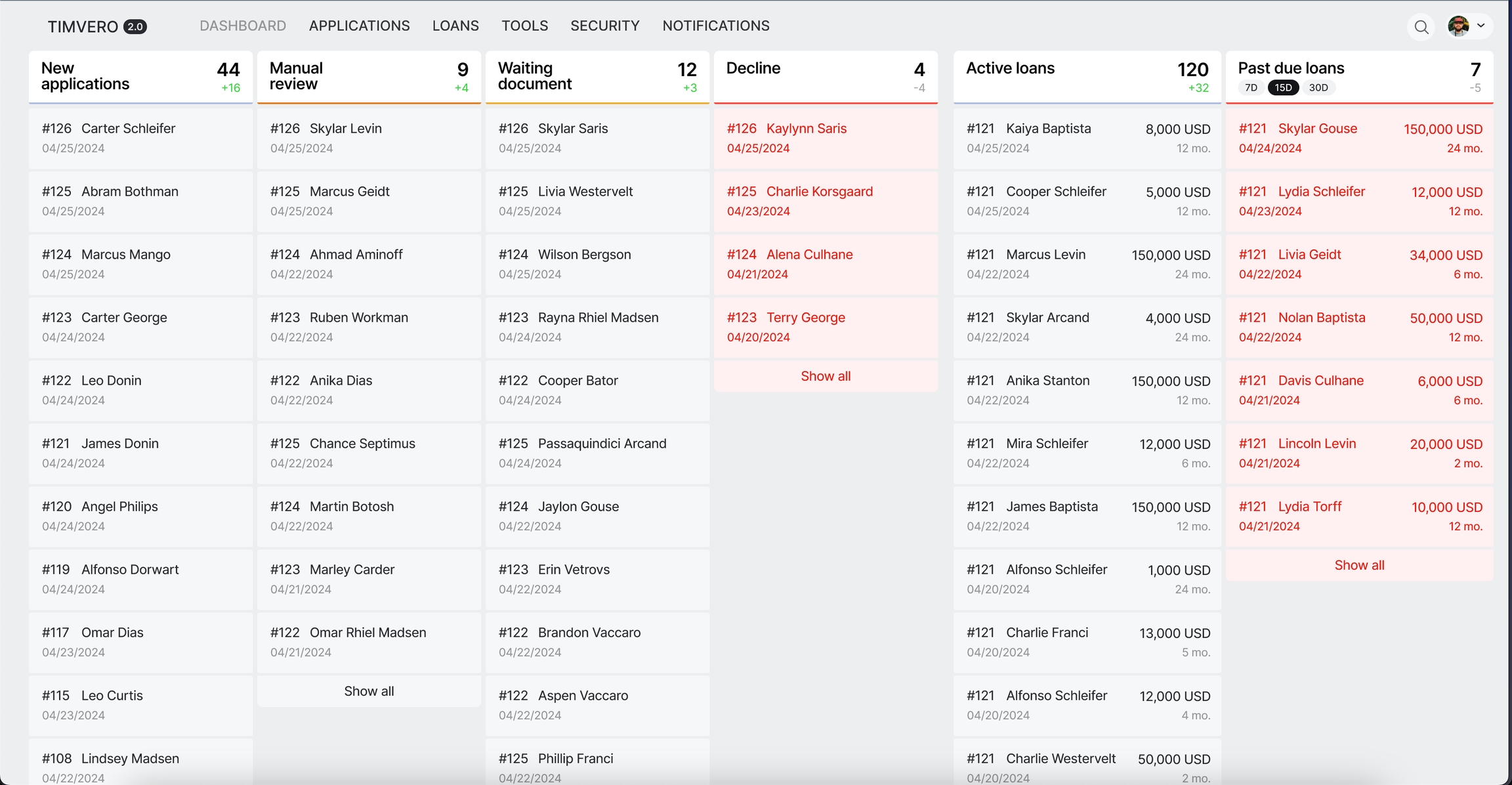

The origination process requires effective management and analysis, which is facilitated by dashboards. These dashboards provide real-time insights into various aspects of the lending process, allowing users to assess current operations through a range of indicators.

For example, dashboards can show metrics such as:

The percentage of client loan applications declined by risk managers

The proportion of clients classified in the amber risk zone

The time taken from application submission to fund disbursement

The percentage of clients in the red risk zone

This data enables Financial Institution (FI) management to perform detailed analyses and make informed adjustments to their risk models.

The system includes a dashboard tool that provides analytical data to users across different roles.