Developing of Participants' or Collateral's evaluation algorithm

Last updated

Last updated

Developing of Participants' or Collateral's evaluation algorithm

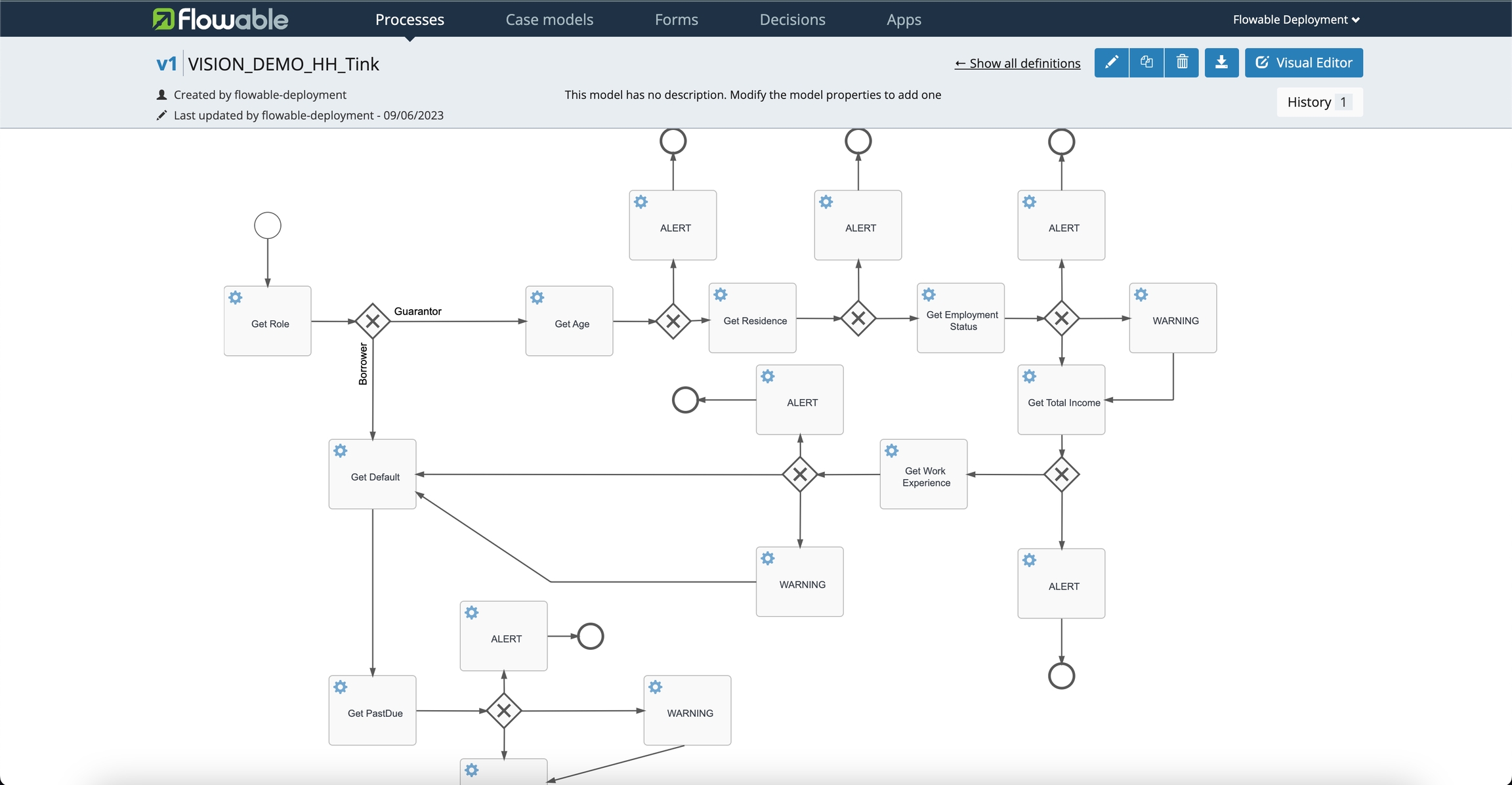

Decision algorithms are set up using a specialized tool called Flowable:

This tool allows FIs to design a scoring process for participants using the features mentioned earlier. When a feature is included in an algorithm, the system retrieves and processes the corresponding data source response:

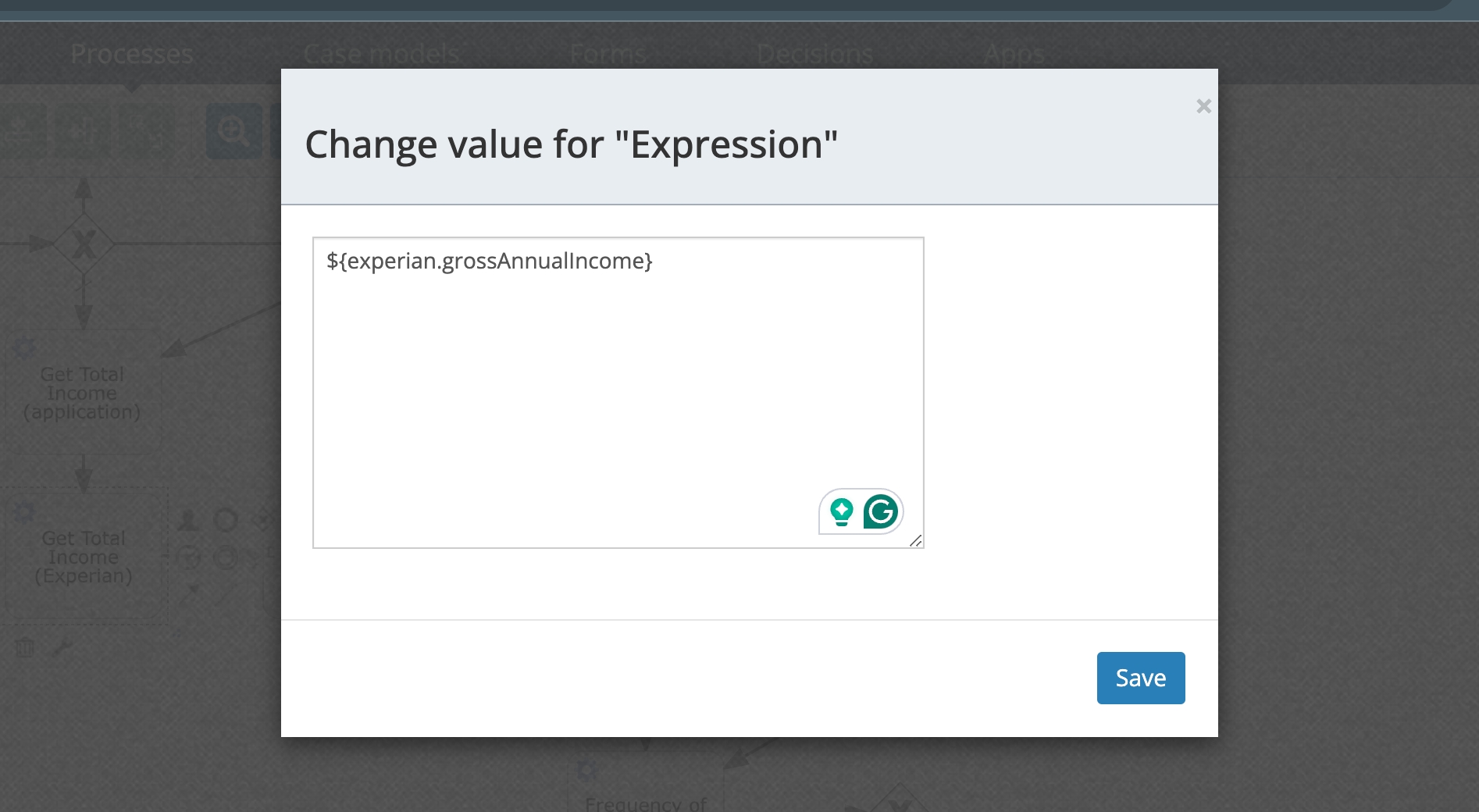

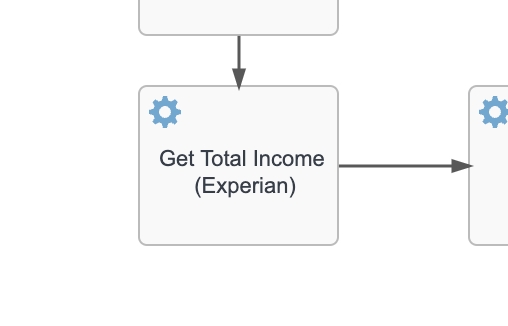

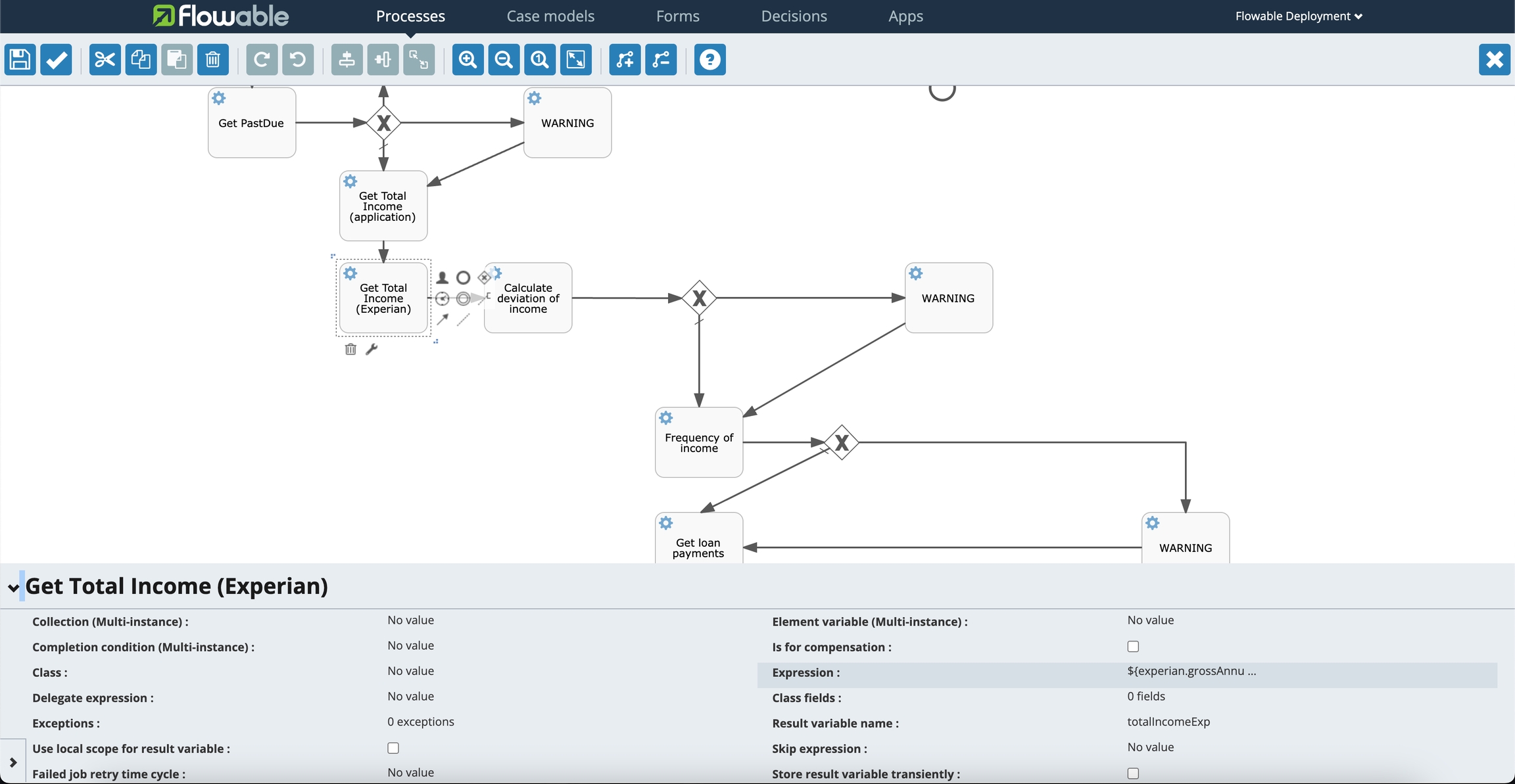

Here is an example of pulling the Experian data source:

No limitations of the complexity of the Decision tree and number of the nodes:

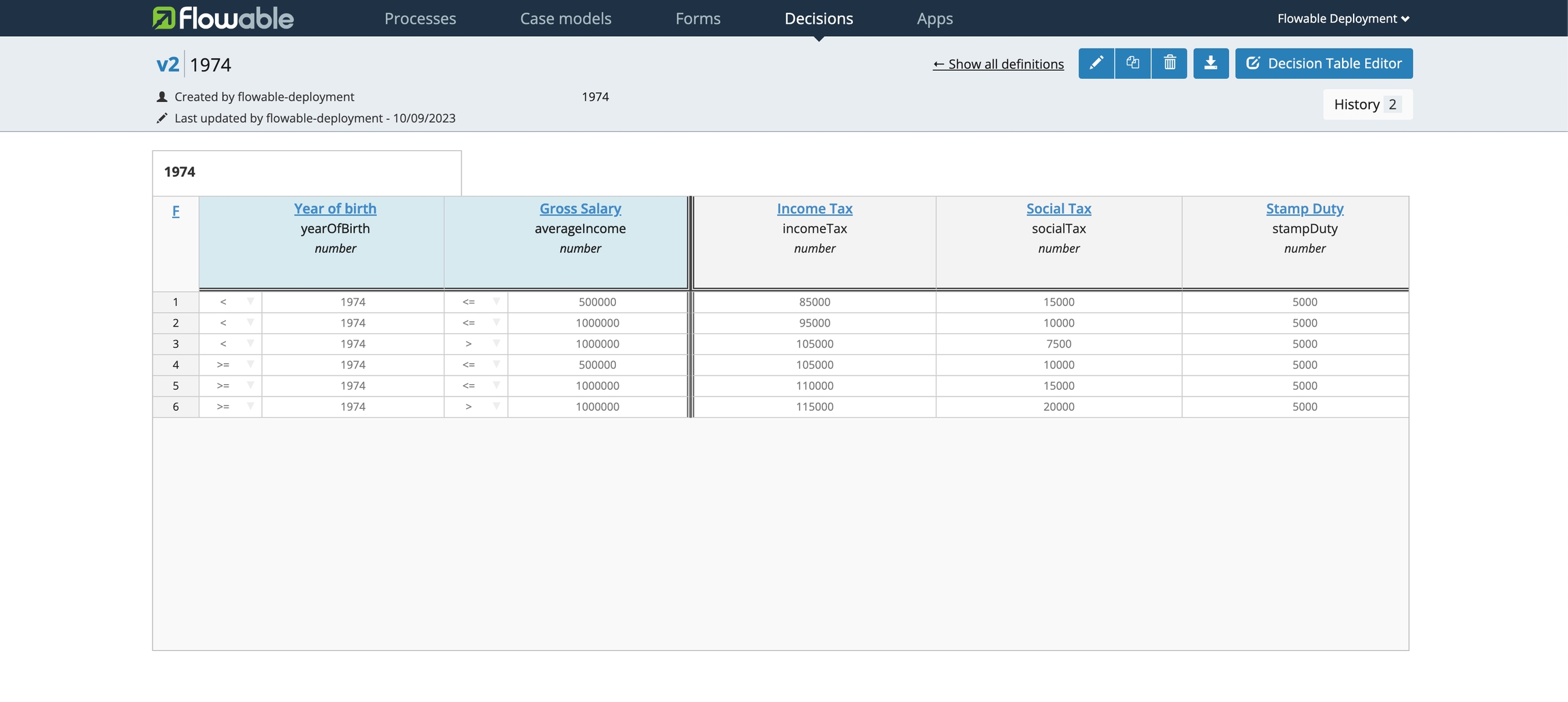

Flowable offers advanced features like Decision Tables, which enable the configuration of complex patterns and equations in a straightforward manner. A simple example might be calculating tax deductions based on a participant's birth year and income. For instance, a feature for grossAnnualIncome in timveroOS.

The decision table logic can be extended to create sophisticated scorecards that provide outcomes based on specific input parameters:

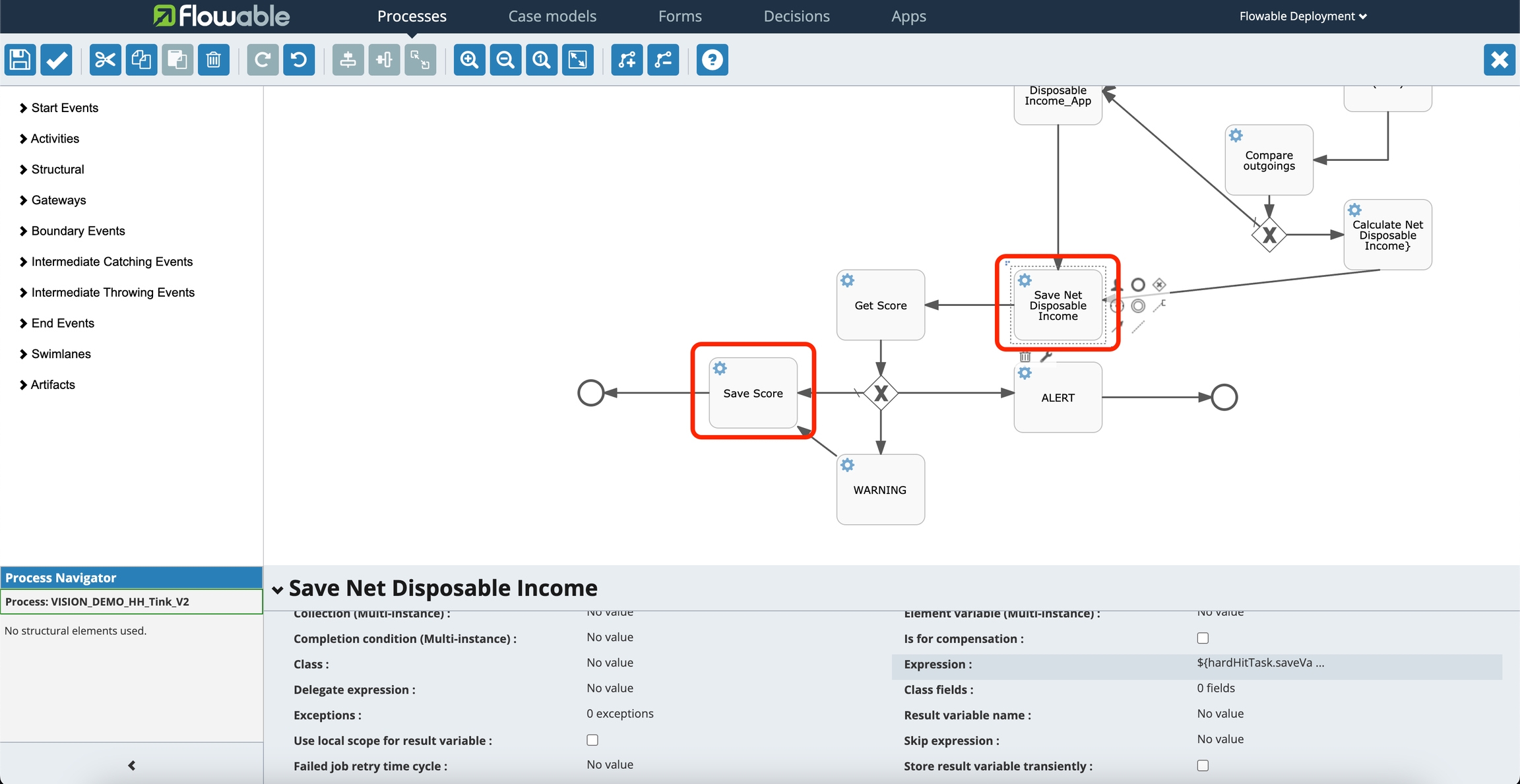

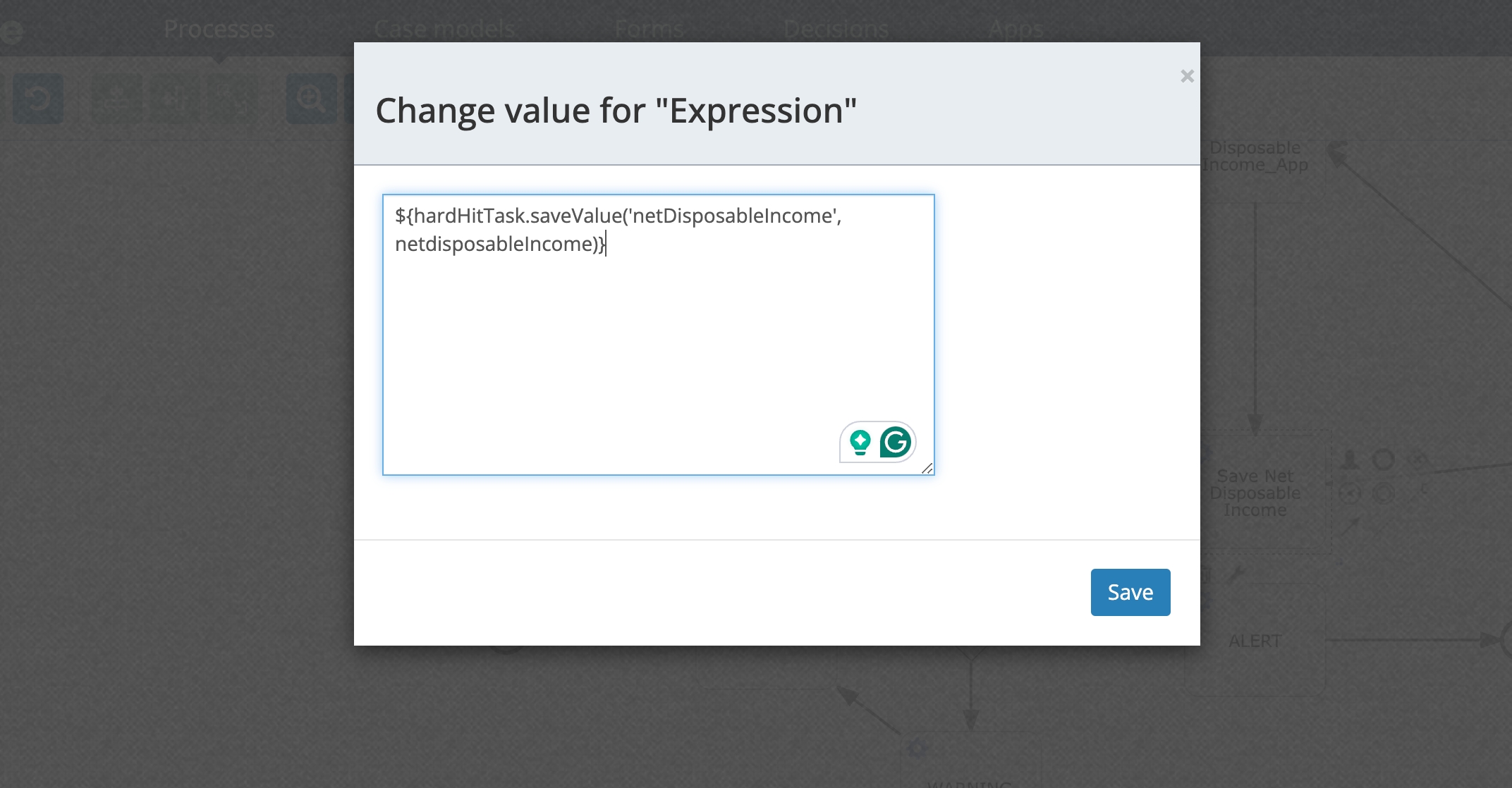

At the end You can save any custom results of node back into the Profile section using specific method "Save".

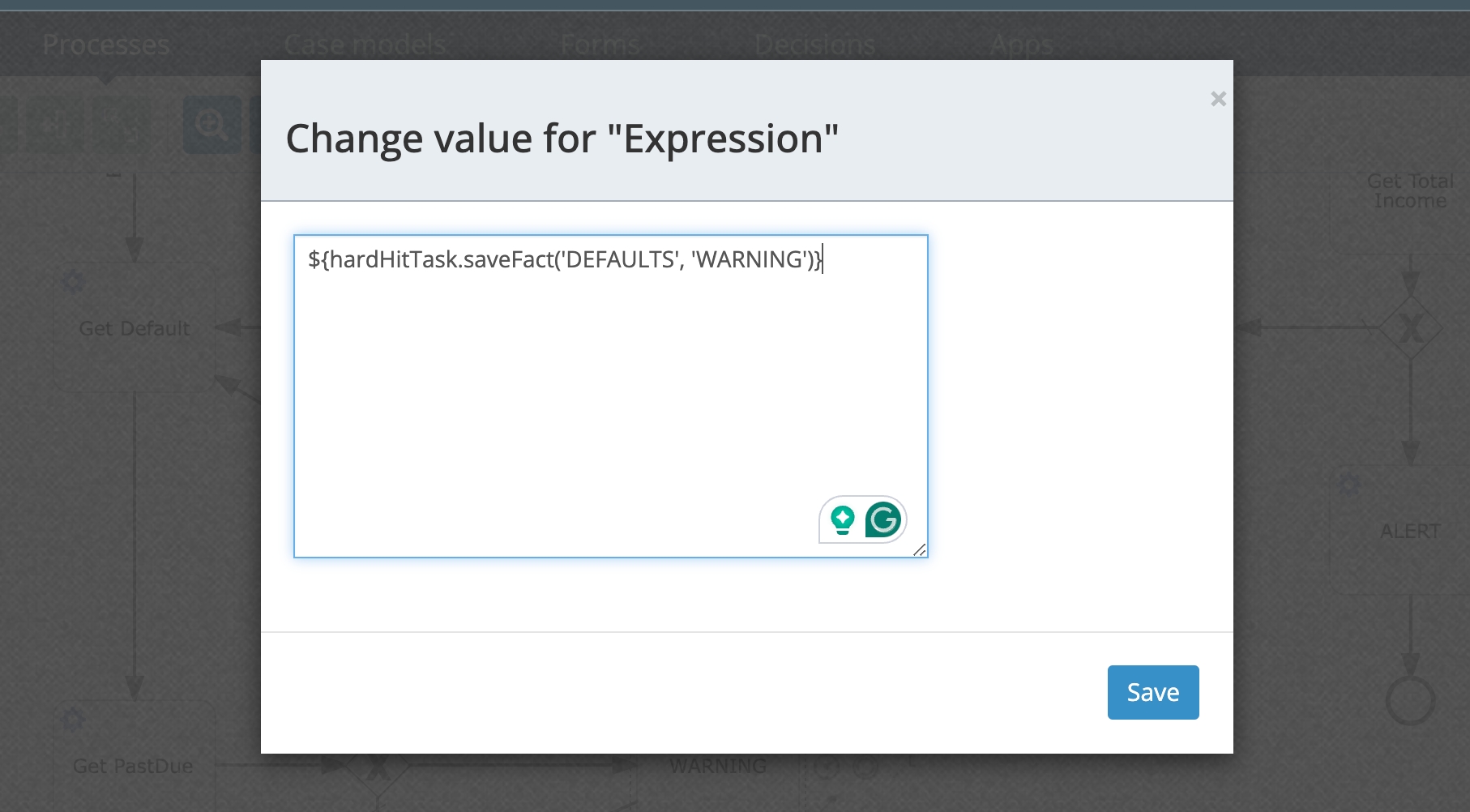

Example of method Save:

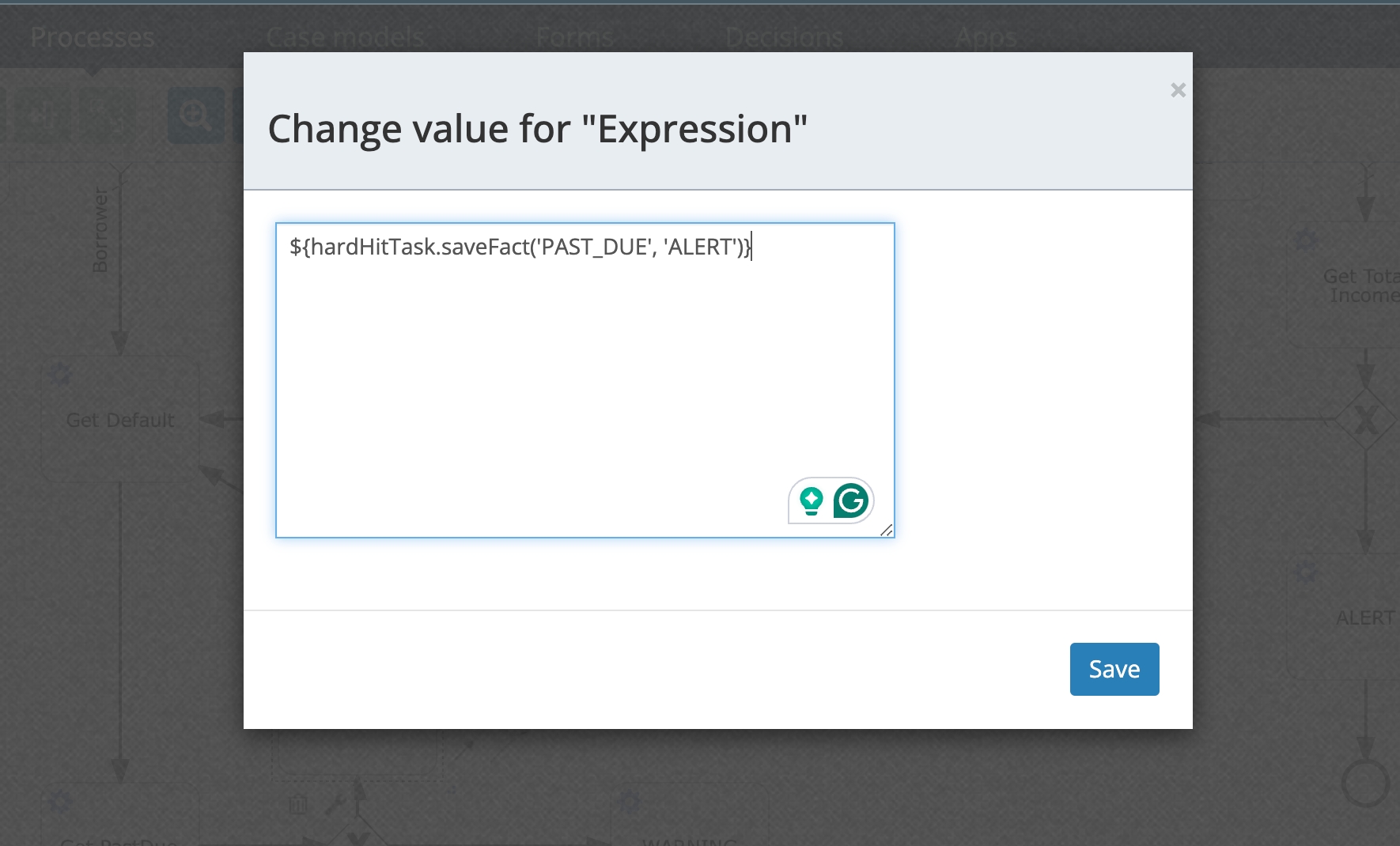

The same method also allows to save parametres that classify clients into distinct risk categories:

Red: Clear credit denial - By using specific "Alerts"

Yellow: Requires further verification - By using specific "Warnings"

In the final rendered tree it looks like:

With the specific tool for Manual Decision-Making Processes, users can set up manual interventions via the Warning/ Alert and Assigning tool.